Corporate Banking

Account Services

Cyberbanking

- Cyberbanking

- Login

- Key Features

- FAQ

- Maintenance Schedule

Looking for question about

Cyberbanking is an innovative and integrated electronic banking service that allows you to access related accounts via the Internet.

With Cyberbanking, you can check your accounts, manage your finances, and transfer funds anytime, anywhere.

If you are a personal account holder with The Bank of East Asia, Limited, Macau Branch ("The Bank" / "BEA Macau Branch"), you can open a Cyberbanking account at BEA Macau Branch.

If you are an account holder of a SupremeGold Account, you are automatically entitled to use the service.

Accessing Cyberbanking via the Internet is simple and easy. Upon account opening, an initial personal identification number ("PIN") will be issued to you for first-time access via the Internet. Simply visit the website www.hkbea.com.mo and click "Macau Cyberbanking". Then enter your unique Cyberbanking account number and PIN to access your Cyberbanking account.

Apart from entering the account number and PIN, you are required to input a one-time password ("OTP") to login to Cyberbanking as an additional form of identity authentication. The OTP will be sent to your registered mobile phone number via Short Message Service ("SMS").

If you have not registered your mobile number for receiving OTPs, you will need to complete registration at Cyberbanking. You can do so by logging in Cyberbanking, choosing "Others" on the left-hand menu, clicking "One-time Password" and entering the required details.

If you have already registered but have troubles receiving the related SMS during login, please visit BEA Macau Branch in person to verify or update your registered mobile number.

For your security, you are required to change your PIN when you access your account for the first time. In addition, you are advised to change your PIN from time to time for added protection.

Yes. If input of OTP is not correct or if OTP expired (only valid for 100 seconds), you need to login again with your Cyberbanking account number and password, then a new OTP will be sent to your registered mobile phone number.

Cyberbanking is provided free of charge.

The daily transaction limits are as follows:

Fund transfers between BEA accounts:

| Type of Fund Transfer | Transaction Limit (per account per day) |

|---|---|

| Fund transfer between SupremeGold sub-accounts (same currency) | No limit |

| Fund transfer between SupremeGold sub-accounts (different currencies) | Please refer below “Exchange limits for different currencies for fund transfer” table |

| Fund transfer to own related accounts or designated third party accounts registered with Cyberbanking | For own related accounts (same currency): No limit For own related accounts (different currencies): Please refer below “Exchange limits for different currencies for fund transfer” table For designated third party accounts (with prior registration) (same currency): HK$50,000 or its equivalent For designated third party accounts (with prior registration) (different currencies): HK$50,000 or its equivalent OR The exchange limits as stated in below “Exchange limits for different currencies for fund transfer” table, whichever is lower |

| Fund transfer to non-registered account* | Same currency: HK$15,000 or its equivalent Different currencies: HK$15,000 or its equivalent OR The exchange limits as stated in below “Exchange limits for different currencies for fund transfer” table, whichever is lower |

* The transaction limit for fund transfers to non-registered accounts will be reset to zero if you do not make such a transaction via Cyberbanking for more than one year.

Other transaction limits:

| Transaction Type | Transaction Limit (per account per day) |

|---|---|

| Bill payment | HK$50,000 |

| Telegraphic transfer | HK$500,000 or its equivalent* |

| MOP/HKD time deposit placement | HK$5,000,000 or its equivalent |

| Foreign currency time deposit placement | HK$2,000,000 or its equivalent |

* Remittances in CNY cannot exceed CNY80,000 per day.

Exchange limits for different currencies for fund transfer:

Deposit

| Currency | Per Transaction | Accumulate Limit Per Day |

|---|---|---|

| AUD | 50,000 | 150,000 |

| CAD | 50,000 | 150,000 |

| CHF | 50,000 | 150,000 |

| EUR | 30,000 | 90,000 |

| GBP | 30,000 | 90,000 |

| HKD | 300,000 | 1,000,000 |

| JPY | 10,000,000 | 30,000,000 |

| NZD | 50,000 | 150,000 |

| SGD | 10,000 | 30,000 |

| USD | 200,000 | 600,000 |

| CNY | 300,000 | 1,000,000 |

| Currency | Per Transaction | Accumulate Limit Per Day |

|---|---|---|

| AUD | 50,000 | 150,000 |

| CAD | 50,000 | 150,000 |

| CHF | 50,000 | 150,000 |

| EUR | 30,000 | 90,000 |

| GBP | 30,000 | 90,000 |

| HKD | 300,000 | 1,000,000 |

| JPY | 10,000,000 | 30,000,000 |

| NZD | 50,000 | 150,000 |

| SGD | 10,000 | 30,000 |

| USD | 200,000 | 600,000 |

| CNY | 300,000 | 1,000,000 |

You can enjoy the following services via Cyberbanking:

For more details, please refer to Section 3, Service Details.

All services appear in Cyberbanking's main menu in a column bar located on the left side of the screen. Simply click on the corresponding button to access the desired service.

Please note that additional services such as "Print", "Message", "Change PIN", "Information", and "Logout" are available below the BEA banner on each page.

The following account types can be registered under Cyberbanking:

An account must be registered before it can be accessed via Cyberbanking.

You can view the service hours of the Cyberbanking services and the types of registered accounts by clicking "Information" below the BEA banner on each page after you have logged in or by calling our E-banking Customer Service Hotline on +853 8598 3688.

To provide the highest level of service quality, Cyberbanking performs weekly system maintenance. Cyberbanking, Mobile Banking and ATM card services are unavailable from 3:00 a.m. to 6:00 a.m. on Sundays and Mondays. For an updated maintenance schedule, please click here.

Please note that all times are expressed in Macau time.

If you access the internet with the recommended hardware, software, and browsers, you can perform transactions 24 hours a day, 7 days a week, wherever you are.

Q3.1.1 What information can I obtain through "Account Enquiry"?

Under "Account Enquiry", you can obtain the following information:

Account Balance:

to enquire about the current and available balances of all registered accounts.

Account Summary:

to enquire about the current and the available balances of all registered accounts.

Account Activity:

to enquire about the current day's transactions, a maximum of the latest 30 transactions up to the start of the previous business day, or the transaction history up to the past 12 months.

Q3.2.1 What does "Fund Transfer" allow me to do?

You can transfer funds from your accounts to other BEA Macau accounts with or without prior registration.

Q3.2.2 What should I do if I want to submit a fund transfer instruction to BEA Macau Branch?

After clicking "Transfers" in the menu, you can input the transaction details. Then, you can click "Proceed" to continue or click "Clear" to reset the screen and input again. On the next screen, you can verify and confirm the transaction details by clicking "Confirm" or cancel the transaction by clicking "Cancel".

Q3.2.3 How can I find out if my fund transfer instruction has been successfully submitted?

If the transaction is accepted, the message "Transaction Completed" will be displayed onscreen along with a transaction reference number. If the transaction is declined, a rejection message will be displayed onscreen. You can also click "Print" to print the transaction record.

Q3.2.4 What does the Scheduler sub-function allow me to do?

The Scheduler sub-function allows you to set up, check, edit, and delete records of scheduled transfers that have not been executed. Please note that schedule transfer transaction is only applicable to fund transfer of same currency.

Q3.2.5 What does the Template sub-function allow me to do?

You can create, change, and delete your templates.

Q3.2.6 If I made a scheduled instruction for a fund transfer, when will the amount be deducted from my withdrawal account?

The Bank will debit the amount from your designated account in the early morning (Macau time) of each scheduled working day.

Q3.2.7 Can I place a one-time or multiple-time scheduled instructions for fund transfers?

Yes, you can place a one-time scheduled instruction or multiple-time scheduled instructions according to any of the following frequencies:

Q3.2.8 If a fund transfer instruction is scheduled to be executed on a Saturday, Sunday, or Macau banking public holiday, when will it actually be executed?

If your instruction is scheduled to be executed on a Saturday, Sunday, or a Macau banking public holiday, it will be executed on the following working day.

Q3.2.9 If my account does not maintain sufficient funds, will the scheduled instruction be executed?

No, in the event that there are insufficient funds in the withdrawal account to complete a scheduled instruction, the Bank will not execute such instruction.

To ensure that the scheduled instruction will be executed in a timely manner, please make sure that there are sufficient funds for the transfer before the date of execution.

Q3.2.10 Can I edit or cancel a scheduled instruction for a fund transfer set up via Cyberbanking if an error is detected?

Yes, you can edit or cancel your instruction before the Execution Date. A new scheduled instruction number will be automatically assigned when you confirm the amendment of the existing scheduled instruction. However, you cannot edit or cancel the instruction on the Execution Date.

Q3.2.11 How can I find out if my scheduled fund transfer was successful on the Execution Date?

If the transaction is successfully executed, the Bank will notify you by sending an email to your designated email address, or you can check your account activity via Cyberbanking.

Q3.2.12 When will I receive an email reminder?

You will receive an email reminder under the following situations:

Q3.2.13 Will there be any notification when I complete the below Instructions:

If you have registered for the One-time Password and Email Address, the Bank will notify you the above-mentioned instruction is accepted by sending a SMS and/or email to your register mobile and/or your designated email address.

Q3.2.14 Can I schedule instructions in a foreign currency?

Yes, but the currency of the scheduled fund transfer must be the same as the account to be debited.

Q3.2.15 If I do not enter an email address during the set-up of a scheduled instruction, will I receive an email reminder?

You will not receive an email reminder if you do not enter your email address during the set-up of a scheduled instruction. You can enter your email address under the following situations:

Q3.2.16 How far into the future can I set the expiry date for a multiple-time scheduled instruction?

The expiry date of a scheduled instruction must be within two years from the set-up date.

Q3.3.1 What does "Bill Payment" allow me to do?

You can settle the bills of credit cards issued by The Bank of East Asia, Limited in Hong Kong using Bill Payment service. Prior registration is not required.

Q3.3.2 What should I do if I want to give a payment instruction to BEA Macau Branch?

After clicking "Bill Payment" on the menu, you can input the transaction details. Then, you can click "Proceed" to continue or click "Clear" to reset the screen and input again. In the next screen, you may verify and confirm the transaction details by clicking "Confirm" or cancel the transaction by clicking "Cancel".

Q3.3.3 How can I find out if my payment instruction under Bill Payment has been successfully submitted?

If the transaction is accepted, the message "Transaction Completed" will be displayed onscreen along with a transaction reference number. If the transaction is declined, a rejection message will be displayed onscreen. You can also click "Print" to print the transaction record.

Q3.3.4 Is Bill Payment a 24-hour service?

Bill Payment service is available Monday to Friday from 0:00 a.m. to 5:00 p.m. and all day on Saturdays, Sundays and Macau banking holidays. Bill Payment transactions will be valued on the next working day if the transaction is completed on a Saturday, Sunday, or Macau banking holiday.

Please note that all hours are expressed in Macau time.

Q3.3.5 What does the Scheduler sub-function allow me to do?

You can set up, check, change, and delete scheduled payment instructions.

Q3.3.6 What does the Template sub-function allow me to do?

You can create, change, and delete your templates.

Q3.3.7 If I place a scheduled instruction to pay a bill, do I need to register the relevant merchant first?

No, you are not required to register a merchant before setting up a scheduled instruction/paying a bill. Your scheduled instruction will be executed on the Execution Date.

Q3.3.8 If I set up a scheduled instruction under Bill Payment, when will the amount be debited from my withdrawal account?

The Bank will debit the amount from your designated account in the early morning (Macau time) of each scheduled working day.

Q3.3.9 Can I place a one-time or multiple-time scheduled instruction for payment?

You can place a one-time scheduled instruction or a multiple-time scheduled instruction according to any of the following frequencies:

Q3.3.10 If the bill payment instruction is scheduled to be executed on a Saturday, Sunday, or Macau bank public holiday, when will it be executed?

If your instruction is scheduled to be executed on a Saturday, Sunday, or Macau banking public holiday, it will be executed on the following working day.

Q3.3.11 If my account does not maintain sufficient funds, will the scheduled instruction be executed?

No, in the event that there are insufficient funds in the withdrawal account to complete a scheduled instruction, the Bank will not execute such instruction.

To ensure that the scheduled instruction will be executed in a timely manner, please make sure that there are sufficient funds for the transfer before the date of execution.

Q3.3.12 Can I edit or cancel a scheduled instruction for a bill payment set up via Cyberbanking if an error is detected?

Yes, you can edit or cancel your instruction before the Execution Date. A new scheduled instruction number will be automatically assigned when you confirm the amendment of the existing scheduled instruction. However, you cannot edit or cancel the instruction on the Execution Date.

Q3.3.13 How can I find out if my scheduled bill payment was successful on the Execution Date?

If the transaction is successfully executed, the Bank will notify you by sending an email to your designated email address, or you can check your account activity via Cyberbanking.

Q3.3.14 When will I receive an email reminder?

You will receive an email reminder under the following situations:

Q3.3.15 Will there be any notification when I complete the below Instructions:

If you have registered for the One-time Password and Email Address, the Bank will notify you the above-mentioned instruction is accepted by sending a SMS and/or email to your register mobile and/or your designated email address.

Q3.3.16 If I do not enter an email address during the set-up of a scheduled instruction, will I receive an email reminder?

You will not receive an email reminder if you do not enter your email address during the set-up of a scheduled instruction. You can enter your email address under the following situations:

Q3.3.17 How long is a multiple-time scheduled instruction valid?

A multiple-time scheduled instruction can last up to 2 years.

Q3.3.18 Can I use different currencies to settle credit card payments?

No, only Hong Kong dollars can be used to settle credit card payments.

Q3.4.1 What should I do if I want to submit a telegraphic transfer instruction?

After clicking "Remittance", you just need to fill in the required information, then click "Proceed" to continue or click "Clear" to reset the screen and input again. On the next screen, you need to input your one-time password, which will have been sent to you, to verify and confirm your telegraphic transfer instruction. Then click "Proceed" to go to the next screen and finally, click "Confirm" to complete the transaction. Otherwise, click "Cancel" to cancel the transaction.

Q3.4.2 What is the service charge for a telegraphic transfer?

For details on the service charges for telegraphic transfers, please visit the BEA Macau website at www.hkbea.com.mo and click "Bank Charges" located at the bottom left side of the screen.

Q3.4.3 What does the Template sub-function allow me to do?

You can create, change, and delete your templates.

Q3.4.4 Will there be any notification when I complete the below Instructions:

If you have registered for the One-time Password and Email Address, the Bank will notify you the above-mentioned instruction is accepted by sending a SMS and/or email to your register mobile and/or your designated email address.

Q3.4.5 When will the amount be deducted after the instruction?

If your instruction is completed during service hours, the remittance instruction will be executed and the related amount and charges will be debited from the withdrawal account on the same day following a review by an officer of the Bank.

If your remittance instruction is submitted after the cut-off time, the instruction will be executed on the following working day.

Q3.4.6 Can I execute telegraphic transfer instructions in different currencies?

Yes, you can. We offer the following currencies telegraphic transfer instructions:

MOP; HKD; CNY; USD; AUD; CAD; CHF; EUR; GBP; NZD; JPY

* The currency of the telegraphic transfer must be the same as the account to be debited.

Q3.5.1 What does the "Time Deposits" function allow me to do?

You can enquire your deposits, place and uplift a deposit, and give deposit maturity instructions in the "Time Deposits" function.

Q3.5.2 Where can I find my time deposit records?

Choose "Summary" to view deposit records of all your time deposit accounts. You can also view the deposit records of each time deposit account.

For details of individual deposits, click on the relevant deposit number.

Q3.5.3 What should I do if I want to submit a deposit placement?

Select "Time Deposits", and "Placement", then input the transaction details and select the maturity instruction. Click "Proceed" to continue or click "Clear" to clear the fields and start over. On the next screen, you may verify and confirm the transaction details (and the interest rate) by clicking "Confirm" or cancel the transaction by clicking "Cancel".

Q3.5.4 What should I do if I want to submit a deposit uplift?

Select "Time Deposits", "Uplift", and then "Uplift" from the table, input the transaction details and click "Proceed" to continue or click "Clear" to clear the fields and start over. On the next screen, you may verify and confirm the transaction details (and the interest rate) by clicking "Confirm" or cancel the transaction by clicking "Cancel".

Q3.5.5 What should I do if I want to submit a maturity instruction?

Select "Time Deposits", "Summary", and then "Add" or "Edit" from the table, select the maturity instruction and click "Proceed" to continue or click "Clear" to clear the fields and start over. On the next screen, you may verify and confirm the transaction details by clicking "Confirm" or cancel the transaction by clicking "Cancel".

Q3.5.6 What deposit types can I operate in the "Time Deposit" function?

Q3.5.7 How do I know whether my deposit placement, uplift, or maturity instruction has been successfully submitted?

If the instruction is accepted, the message "Transaction Completed" will be displayed onscreen along with a transaction reference number. If the instruction is declined, a rejection message will be displayed onscreen. You can also click "Print" to print the transaction records.

Q3.5.8 What kinds of instructions can I place in the "Add Maturity Instruction" or "Edit Maturity Instruction"?

There are three types of instructions available:

Q3.6.1 How can I share my comments or queries with the Bank regarding Cyberbanking?

You can send an electronic message to us by clicking "Message".

Q3.6.2 How many messages can be retained in my Inbox and Outbox, and how long can these messages be retained?

Your Inbox and Outbox can retain a maximum of 30 messages each for up to 4 years.

Q3.7.1 How can I change my Cyberbanking PIN?

You can change your PIN by clicking "Change PIN" located at the top right hand corner below the BEA banner on each page of your Cyberbanking. After input of your existing PIN and your new PIN, you will need to key in your one-time password ("OTP") and answer a Security Question ("SQ"), then the new PIN will be successfully changed.

Q3.8.1 How can I change my email address?

You can click "Register or Change Email Address" under "Others", then input your new email address and click "Proceed".

On the next screen, you may verify your new email address and then click "Confirm".

Q3.8.2 Will there be any notification when I complete the registration/change of email address?

If you have registered for the One-time Password and Email Address, the Bank will notify you the registration/change of email address is accepted by sending a SMS and/or email to your register mobile and/or your designated email address.

Q3.9.1 What is a one-time password?

A one-time password ("OTP") is an SMS-based password generated by the Bank and sent to your registered mobile phone number as an additional form of identity authentication. An OTP enables you to perform designated transactions via Cyberbanking. Each OTP can only be used for one time for each designated transaction and will be expired after 100 seconds.

Q3.9.2 How do I use a one-time password?

When you perform a designated transaction via Cyberbanking, a one-time password ("OTP") will be sent to your registered mobile phone number via Short Message Service ("SMS"). You must input the OTP to complete your transaction.

Q3.9.3 When do I need to use a one-time password and answer the security question?

You need to use a one-time password when conducting any of the following designated transactions:

Apart from using an OTP, you also need to answer the security question when conducting any of the following designated requests:

Q3.9.4 Do I need to use a one-time password when I perform transactions using the template?

Fund transfer/bill payment:

You do not need to use a one-time password to complete the transaction unless you change the deposit account or bill account number in the template.

Telegraphic transfer:

You do not need to use a one-time password to complete the transaction unless you change any of the required information in the template.

Q3.9.5 Do I need to visit BEA Macau Branch for registration of using one-time password?

No, you can simply register for one-time password ("OTP") at Cyberbanking. You can do so by logging in Cyberbanking, choosing "Others" on the left-hand menu, clicking "One-time Password" and entering the required details.

Q3.9.6 What is a BEA Authentication Message?

The BEA Authentication Message will appear on your mobile phone to identify BEA as the sender of an SMS communication. You have to create your own content for this authentication message (up to 15 numbers and/or English letters).

Q3.9.7 Why am I unable to successfully register for using one-time password?

For registration of using one-time password, the mobile phone number that you are using must be the same as the one on record at the Bank.

If you have already registered but have troubles receiving the related SMS during login, please visit BEA Macau Branch in person to verify or update your registered mobile number.

Q3.9.8 What should I do if I receive an SMS containing a one-time password on my mobile phone but am not performing any Internet banking transactions?

Please contact BEA Macau Branch or our E-banking Customer Service Hotline on +853 8598 3688 immediately for assistance.

Q3.9.9 Is there any charge for using one-time passwords?

Your mobile network operator may charge you an SMS usage fee for accessing such services. For details, please refer to your mobile network operator.

Q3.9.10 Do I need to register for SMS with a telecommunication company in order to receive Cyberbanking SMS messages?

No, you do not need to apply for SMS with your telecommunication company in Macau as all mobile phones are capable of receiving SMS. For international SMS, please check with your mobile network operator.

Q3.9.11 Can I register an overseas mobile phone number for one-time passwords?

You can register an overseas mobile phone number for the service. Mobile phone numbers in the following countries currently support the service:

North America

| Country / Region | Country / Region Code |

|---|---|

| US | 1 |

| Canada | 1 |

Europe

| Country / Region | Country / Region Code |

|---|---|

| Russia | 7 |

| Greece | 30 |

| Netherlands | 31 |

| Belgium | 32 |

| France | 33 |

| Spain | 34 |

| Hungary | 36 |

| Italy | 39 |

| Swiss | 41 |

| Austria | 43 |

| UK | 44 |

| Denmark | 45 |

| Sweden | 46 |

| Norway | 47 |

| Poland | 48 |

| Germany | 49 |

| Portugal | 351 |

| Luxemburg | 352 |

| Ireland | 353 |

| Finland | 358 |

| Czech Republic | 420 |

Asia

| Country / Region | Country / Region Code |

|---|---|

| Malaysia | 60 |

| Indonesia | 62 |

| Philippines | 63 |

| Singapore | 65 |

| Thailand | 66 |

| Japan | 81 |

| South Korea | 82 |

| Vietnam | 84 |

| Chinese Mainland | 86 |

| India | 91 |

| Hong Kong | 852 |

| Macau | 853 |

| Taiwan | 886 |

| Israel | 972 |

Oceania

| Country / Region | Country / Region Code |

|---|---|

| Australia | 61 |

| New Zealand | 64 |

Remarks: Not all mobile phone numbers from the above-mentioned countries and regions can receive an international SMS messages. Prior to service registration, please confirm with your mobile network operator whether your mobile phone number/service plan can receive an international SMS.

Q3.10.1 What information can I obtain through "Information"?

You can view the following:

Q3.11.1 How do I report a lost ATM card?

Click "Cards" and then "ATM Card" from the main Cyberbanking menu, select the ATM card and then click "Report Loss" to report a lost card and suspend ATM card services.

Q3.11.2 When do I need to use the Overseas ATM Cash Withdrawal Settings?

If you need to withdraw cash from an ATM outside Macau, you must activate the overseas ATM cash withdrawal function in advance by setting the activation period and daily withdrawal limit.

Q3.11.3 What can I do on the Overseas ATM Cash Withdrawal Settings page?

You can activate or deactivate overseas ATM cash withdrawals as well as edit the activation settings.

Q3.11.4 When do I need to activate the overseas ATM cash withdrawal function?

You are required to activate the overseas ATM cash withdrawal function before travelling. Your first overseas cash withdrawal should be made no more than six months after the activation start date that you set.

Q3.11.5 Is there any restriction on when I can set the end date?

Yes, the overseas ATM cash withdrawal activation end date should be within 5 years of the start date, or on the card expiry date, whichever is earlier.

Q3.11.6 What is the maximum overseas ATM daily withdrawal limit?

The maximum overseas ATM daily withdrawal limit is MOP20,000 or its equivalent per day per card, with a minimum cash withdrawal of MOP100 or its equivalent. You can set the limit to MOP100 or a multiple thereof.

Q3.11.7 How do I know whether the overseas ATM cash withdrawal function has been activated or its settings have been changed successfully?

The Bank will send an SMS message to your registered mobile phone number once the overseas ATM cash withdrawal function has been activated or its settings have been changed successfully. However, when deactivating the overseas ATM cash withdrawal function, no notification SMS message will be sent.

Q3.11.8 What can I do on the Point of Sale (POS) Settings page?

You can activate POS or edit the activation settings.

Q3.11.9 Is there any restriction on the POS limit setting?

The maximum POS limit is MOP50,000 or its equivalent per day per card. You can set the limit to 0 or a multiple of MOP100.

Q3.11.10 What is CyberAlert?

CyberAlert is a mobile phone alert service for our ATM cardholders. It provides real time SMS message alerts after an ATM cash withdrawal or POS transaction is made that is equal to or over a pre-defined transaction amount.

Q3.11.11 What can I do on the CyberAlert Settings page?

You can activate or deactivate CyberAlert as well as edit the pre-defined transaction amount.

Q3.11.12 Are there any restrictions on the CyberAlert settings?

The maximum pre-defined amount is MOP20,000 or its equivalent per transaction, with a minimum pre-defined transaction amount of MOP100 or its equivalent. You can set the amount to MOP100 or a multiple thereof.

For security reason, overseas ATM cash withdrawals in any amount have to set up with SMS alert function. For your protection, please ensure your mobile is switched on and can receive overseas ATM cash withdrawal alerts when abroad.

Q3.12.1 Where can I go for information about the Mobile Banking service?

Please refer to "Questions about BEA Macau App" in Section 9.

Q3.13.1 What information can I obtain through the "Rate Enquiries" function?

You can view the following financial information:

Q3.14.1 What does the "Cheque Book Requisition" function allow me to do?

You can request cheque book. The service charge will be debited from the account.

Q3.14.2 How will I receive my cheque book?

You can choose to pick up your cheque book at BEA Macau Branch or to have your cheque book delivered by registered mail. If you choose to have your cheque book delivered by registered mail, the cheque book will be mailed to your correspondence address on record at the Bank, the postage will be debited from your current account.

Q3.14.3 Will there be any notification when I complete the cheque book requisition?

If you have registered for the One-time Password and Email Address, the Bank will notify you the cheque book requisition is accepted by sending a SMS and/or email to your register mobile and/or your designated email address.

Q3.15.1 What is the purpose for making "DSF Tax Refund or Other Payments Registration"?

By means of this function, you can register your account at BEA Macau Branch to receive the tax refund or other payments from Financial Services Bureau (DSF) via bank transfer.

Q3.15.2 What is the fee and procedures for the registration?

The registration is free of charge. You can simply complete and submit the form online to register. All applications submitted online will be sent to the Financial Services Bureau (DSF) on every Monday for confirmation. (If Monday falls on a holiday, the process will be postponed to the next working day).

Q3.15.3 Is the registration applicable to all types of account?

The registration is only applicable to personal bank accounts in MOP and account holders have to be aged 18 or above. Joint accounts cannot be registered.

Q3.15.4 Will there be any notification when I complete the registration?

Upon completion of the registration, an online message " Registration Completed" will be shown to confirm your successful registration. The Bank will not notify you again by sending a SMS and/or email.

Please note the following recommended equipment:

| Hardware Requirements | Minimum Requirements |

|---|---|

| Personal Computer ("PC") | Pentium III 500MHz or higher of IBM-Compatible PC with mouse |

| Main Memory | 128 MB or above |

| Modem | 56kbps modem or faster Internet connection |

| Monitor & Best Resolution | SVGA Monitor, 800 x 600 |

| Software Requirements | Minimum Requirements |

|---|---|

| Operating System | English or Traditional Chinese Version Windows 2000 or later |

| Browser |

|

The Print button is always available below the BEA banner on each page. Simply click it whenever you want to print the information displayed onscreen.

Click "Log out" whenever you want to exit the service. Log out buttons appear in the upper right corner below the BEA banner.

You can call our E-banking Customer Service Hotline on +853 8598 3688.

You can log in to Cyberbanking again and check your transaction details and balance(s) under "Account Activity" and "Account Balance" respectively or you can call our E-banking Customer Service Hotline on +853 8598 3688.

For the security reasons, these browser functions and tool bars are not provided when you log in to Cyberbanking.

If you have not installed JVM or cannot find the Java Control Panel on your computer, please download and install the Oracle (Sun) Java Virtual Machine at www.java.com.

(Supported version: Oracle (Sun) Java Virtual Machine (JVM) version 7)

You should check your modem settings or the connection to your Internet Service Provider ("ISP"). Difficulties may also be due to periods of peak traffic on the Internet. Please try again to connect.

You can download Java Virtual Machine ("JVM") at java.sun.com/getjava/installer.html by following the installation instructions provided on the website.

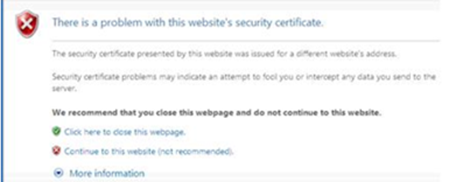

If you receive a security certificate warning (similar to the screen displayed below), which may indicate that a security certificate does not belong to our Bank, you should discontinue to login to or use Cyberbanking and inform us immediately.

You can safely log in to Cyberbanking by entering the BEA Macau website URL, www.hkbea.com.mo, into your browser, or bookmark this authentic website for subsequent access. Never use website addresses or links attached in any email or found through Internet search engines to log in to Cyberbanking.

Cyberbanking provides the following security measures to safeguard your use of the service:

You can log in to Cyberbanking by using your Cyberbanking account number and PIN.

You can view your last login time after successfully logging in to Cyberbanking.

"TLS" is an international and well-proven standard encryption module developed to ensure confidentiality during date transmission. All important information transmitted between your browser and our Bank through Cyberbanking will be encrypted by using at least 128-bit TLS.

Before using Cyberbanking, you should click "Information" below the BEA banner on the webpage and read the precautions in "Important Notes".

To safeguard your account information, you are advised to close all your browsers instantly after logging out of Cyberbanking to clear the browser memory cache.

Please note that the BEA Group currently maintains the following websites only:

Remarks: Customers will never be asked for any personal information by email, e.g. name, account number, password, etc. To securely view or use the websites of the BEA Group, please input the URL into the address field onscreen or simply access our homepage at www.hkbea.com.mo and never access a URL by clicking on hyperlinks attached to any email. For further information, please contact our E-banking Customer Service Hotline on +853 8598 3688.

You should use a browser that Cyberbanking can support (see FAQ Q4.1). In addition, Java, JavaScript, TSL, and cookies options must be enabled in the browser.

If you want to upgrade your browser version, you may go to the corresponding download sites. Alternatively, you may choose the browser you wish to upgrade in the error page when you enter our webpage once you log in to Cyberbanking. After making your selection, you will be redirected to the appropriate site for downloading.

To enable TLS version 1.2 in Internet Explorer 8.0, please follow the steps as follow:

For Internet Explorer 8.0*:

(* Please refer to the HELP contents of your browser for other versions.)

Some of the latest browser versions have features such as AutoComplete in Internet Explorer, which can save previous entries you have made for web addresses, forms, passwords, etc. Therefore, when you type similar information in one of these fields, a dropdown list with possible matches will automatically appear from which you can select.

To protect yourself and to prevent unauthorised use of your account, you are advised to disable this kind of feature in your browser. You may also lock your personal computer by using power-on passwords etc. to prevent unauthorised access.

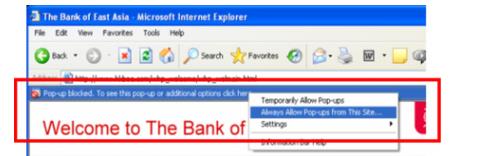

This message appears when the pop-up blocker function of your IE browser has been activated and the filter level is set to [High: Block all pop-ups [Ctrl to override]].

As Cyberbanking needs the pop-up function in order to display the login menu, you should select one of the following option to adjust the browser setting in order to access Cyberbanking service.

A. Reset the filter level to "medium".

B. Accept Cyberbanking as a website with pop-up function.

C. Accept Cyberbanking as an exceptional website for the pop-up blocker.

Option A: Set the filter level of the pop-up blocker to [Medium: Block most automatic pop-ups]

1. Open IE browser

2. Under the Tools menu, select Pop-up Blocker, and then click "Pop-up Blocker Setting"

3. Select "Medium: Block most automatic pop-ups" in the box near the bottom of the dialog box.

Option B: Accept Cyberbanking as a website with pop-up function.

Step 1. Select the pop-up blocker bar when it appears, and then click "Always allow the pop-up from this site..." in the pop-up menu.

Step 2: Click "Yes" in the confirmation window to complete the setting.

You can contact BEA Macau Branch, or call our E-banking Customer Service Hotline on +853 8598 3688.

For phone number and address of BEA Macau Branch, please visit Contact Details page.